We Bring Finance Fundamentals to Life

“Learning by Doing” focusing on the practical application of case studies and real-world examples. Each learning module explores finance theory and fundamentals with reinforcement through Excel examples and exercises. Courses stress the consistency, clarity, and efficiency required when analyzing complex situations and concepts. Our goal is to put the fundamentals of finance at your fingertips.

It’s more than what we teach, it’s how we teach it.

TTS’s Public Courses will benefit individuals who are seeking a better understanding of how to analyze and value a company using traditional Wall Street methodologies. Our intensive workshops enable individuals to develop the same knowledge of finance that participants derive from a standard entry-level training and through continuing development coursework under a corporate sponsor. All participants who attend the public course training receive a certificate of completion listing the details of the training session(s) attended.

In-person

How do you Learn? Our courses are available in both in-person or virtual classroom formats. If you learn better in your own space or traveling isn’t convenient, virtual is great solution. Either way, you get the skills you need to succeed.

Virtual

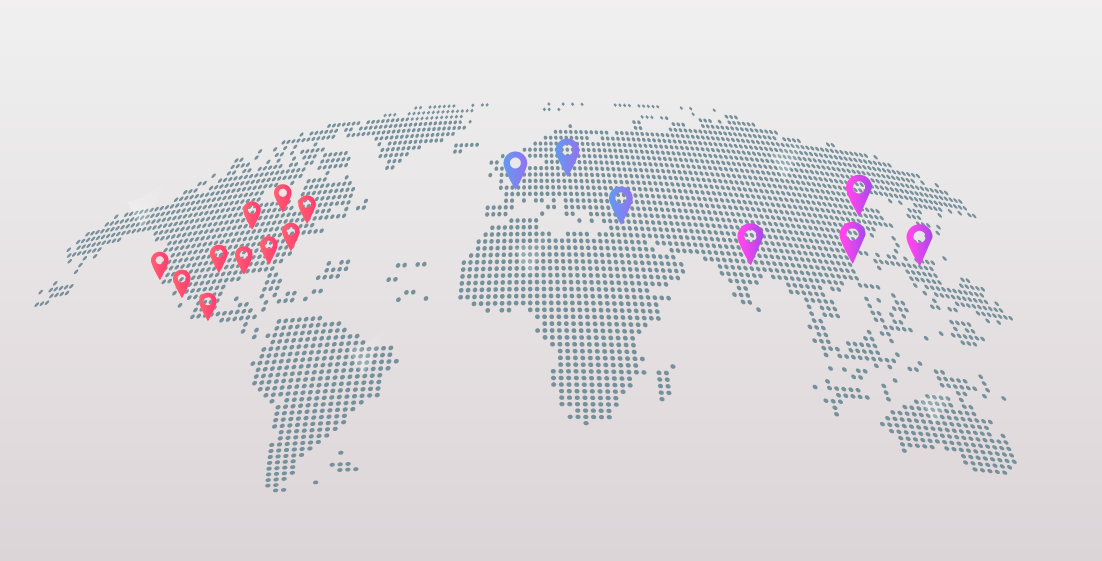

Courses available across global locations and time zones paired with the option of virtual or in-person formats draws participants from diverse regions and locations, as well as industries.

North America

Atlanta, Charlotte, Chicago, Dallas, Los Angeles, Mexico City, New York, San Francisco, Toronto, and Washington DC

Europe, the Middle East, and Africa

Dubai (United Arab Emirates), London (United Kingdom) and Frankfurt (Germany)

Asia

Hong Kong, Shanghai (China), Singapore, New Delhi (India)