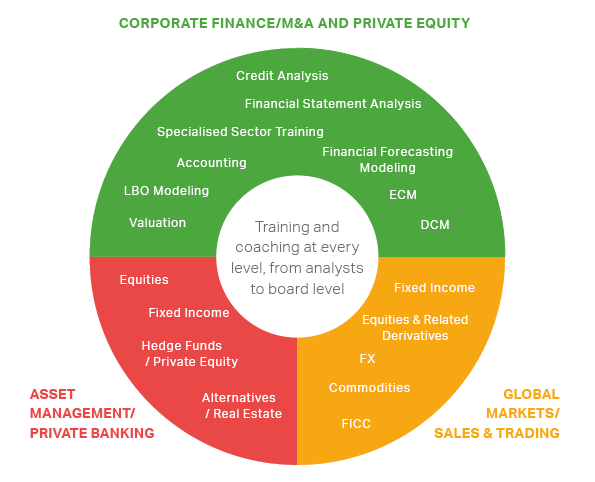

Asset Management Training Courses

In today’s market environment, the world’s investors are increasingly demanding. Asset managers and private bankers need to demonstrate how they add value, and increasingly we find clients seeking more fundamental training, to allow analysts and portfolio managers to better analyst companies and projects from a bottom up perspective.

We equip our clients to build their own forecast models with confidence, and to perform relative value analysis in a clear and consistent manner. Our teaching covers investments in corporate equity and debt, real estate, project finance and private equity. We have developed a number of courses suited to our clients, which range from the world’s largest asset managers to boutique investment houses, family offices, sovereign wealth funds and private banks.

Corporate Finance Training Courses

AMT are leading experts when it comes to equipping your employees with the skills required in a challenging industrial environment. From analysts and associates to VPs and MDs, we have comprehensive experience building in-house programs with the perfect organizational fit. We pride ourselves on having trained many of today’s globally recognized senior bankers.

Our training ensures that your bankers are equipped with state of the art technical skills while always understanding investment banking for what it is; a complex, bespoke service requiring a different solution not just for every client, but every deal.

Global Markets Financial Training

AMT’s Global Markets sector serves professionals involved in every aspect all major securities and derivatives markets. From sales and trading and inter-dealer broking, through to support functions such as operations, risk management and infrastructure, every business that is involved in global markets will be served with bespoke content. We also work with a variety of exciting and interactive trading simulations that can be incorporated into training programs, ranging from one hour, to four weeks.

Industry Specific and Specialist Training

Whether on the sell-side, buy side or working at a corporate, many clients require sector specific training due to the unique aspects of their sector specialty. While we have a number of case studies in a variety of sectors, and frequently build out new case studies to client’s specifications, we have built our more formal learning materials for key industries such as financial institutions and oil & gas. We have the capabilities to develop further sector specific training based on demand.

We also offer advanced Excel training which will help any financial professional get more out their spreadsheets. Our power modeling training sessions are amongst our most universally popular across all clients.

Private Equity, Investment and Corporate Development Training

With AMT’s market-leading position in training M&A analysts and associates on the sell-side, it was a natural progression that we started to with the clients of investment bankers; Private Equity and Corporates. While the skill set needed in Private Equity and Corporate Development, we have a different approach to training those who will make investment/ divestment decisions.

For our Private equity clients we can delve deeper into the modeling of LBOs, re-capitalizations and funding and hedging choices, while for our Corporate Development clients we get more industry specific training requests, where we customize our training models to analyst case study firms in the industry in which our clients operate.

Alternative Investments

This program branches out from traditional asset classes and explores the increasingly popular world of alternatives. By the end of the program delegates will be able analyse the most common alternative investment opportunities and decide how such exposure can sit alongside more traditional fixed income and equity portfolios. The pros and cons with respect to returns, risk, transaction costs, liquidity and correlation will be emphasized throughout.

Each of the major alternative asset classes are introduced before a more meaningful session on each follows. Returns, volatility and correlation of each are presented.

Key topics:

- Hedge funds

- Private equity

- Real estate

- Commodities

- Infrastructure

- Major players

- Historic returns and risks