What is a call spread overlay?

The use of the call spread option strategy by issuers of convertible bonds. By overlaying call spread option over a convertible bond the issuer can synthetically alter the exercise price of the convertible bond.

What is a short call spread?

A short call spread is an alternative to the short call. In addition to selling a call with strike A, you’re buying the cheaper call with strike B to limit your risk if the stock goes up. But there’s a trade-off — buying the call also reduces the net credit received when running the strategy. (Source: optionsplaybook.com)

Bridging the Gap Between Convertible Bond Issuers and Investors

Growing in popularity recently is the call-spread overlay–a relatively simple derivative structure that can alter the structure of a convertible bond (CB), or exchangeable bond, from the perspective of the issuer. So how does it work?

Take for example ABC Corp. Their common stock trades at $80 and they wish to raise $12m by issuing 100,000 CBs with a par value of $120, convertible into one common share. That is to say ABC Corp wishes to set a conversion premium of 50%; their stock will have to rally by 50% before conversion becomes probable, and existing shareholders will be diluted.

ABC’s advisors inform them that the market has no demand for CBs with a 50% conversion premium, rather setting a conversion premium of 25% will get more traction. ABC is advised to issue 120,000 bonds with a par value of $100, each convertible into one share of common stock. While this proposal will allow ABC to issue at a tighter yield relative to their original structure, they are unhappy that shareholders will get diluted after a 25% rally in share price.

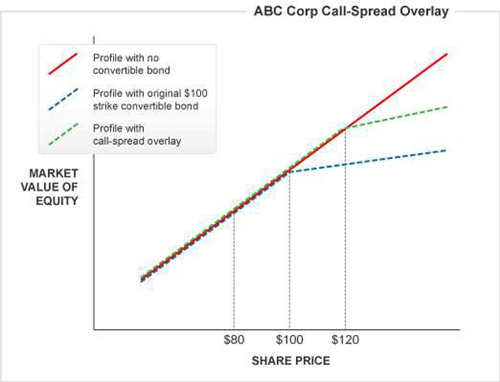

This is where the call-spread comes in. From the perspective of the issuer, this CB is a combination of a putable bond, and a short call set at a strike price of $100. ABC does not want to be short this call option – it does not want to issue stock and dilute shareholders at $100. It is more comfortable with a strike price of $120. ABC wishes to buy back a call option struck at $100 and sell a call option struck at $120 – this sounds just like a call-spread from your Options 101 class. As the issuer is buying the lower strike call, and selling the higher strike call, this of course carries an up-front cost.

By ‘overlaying’ this costly conventional call spread on a short CB position the issuer has effectively given up some of the premium implicitly paid by CB investors for their in-built call- options, in exchange for pushing the price at which dilution will occur up by 20%. As with the market for corporates to swap fixed coupon debt into floating rate payments through interest rate swaps, this is another nice example of how derivatives can be used to bridge the gap between the needs of investors and issuers.

Please do not hesitate to contact us, if you are having trouble viewing or accessing this article.

Copyright© 2016 AMT Training