A corporation which sponsors a defined benefit pension plan is exposed to the associated investment risk via the pensions guaranteed to employees. If that plan is in deficit then this may be significant to the valuation. This article focuses on the numbers that might impact a valuation. As a valuation specialist, detailed knowledge of pension accounting is unnecessary but it is vital to be comfortable with the “what and where” of the main pension numbers in a set of financials.

Download the accompanying Excel files which can be used to calculate the numbers in the examples used.

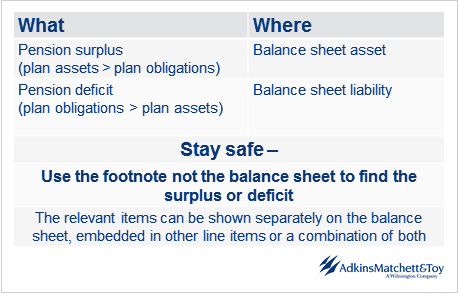

Pensions in the balance sheet

The accounting engineering is straightforward and works as follows (assuming the deficit increases over the period):

The cash is the contribution to the plan, the pension liability increase is the deficit increase over the period and the equity is plugged with the difference.

-

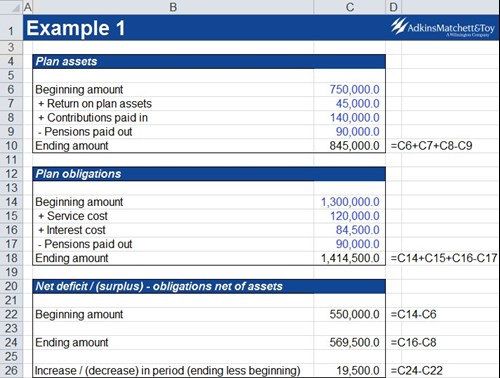

Example 1

The pension deficit has increased over the period as illustrated below.

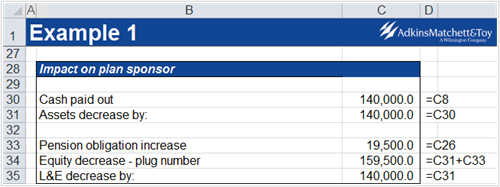

The accounting engineering results in the following:

Pensions changes to equity

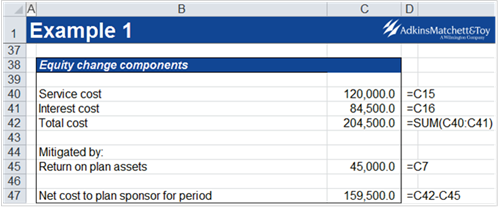

Changes to equity can be effected by a direct change to equity in the statement of comprehensive income or via the income statement / profit and loss account. Reported profits are impacted by those items in the income statement / profit and loss account only so this distinction is significant. In the case of example 1, the income statement is impacted as follows:

IFRS vs GAAP pension accounting

In reality the plan assets are also impacted when the actual return is different to that expected – called an experience gain or loss and the plan obligations are impacted by changes to assumptions made by the actuary – called actuarial gains and losses. There are three methods currently in use with regard to the treatment of experience and actuarial gains and losses. US GAAP allows two possible methodologies whilst IFRS has only one method in operation. To compare the reported earnings of three businesses (as is done in comparables valuation) with each using one of these methodologies means the earnings are not comparable without “cleaning up” for the pension expense numbers.

-

Example 2

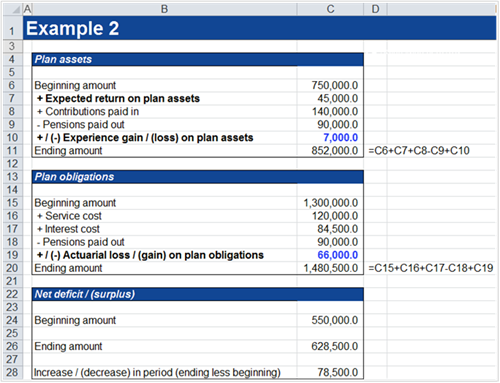

Example 2 includes these issues and produces the following result:

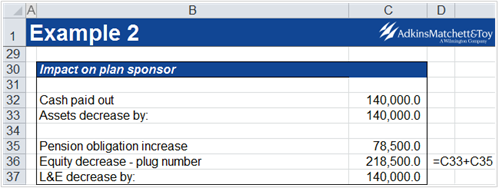

The engineering on the balance sheet is the same as in example 1:

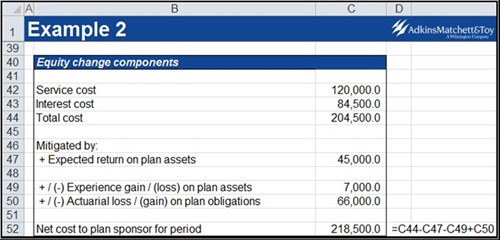

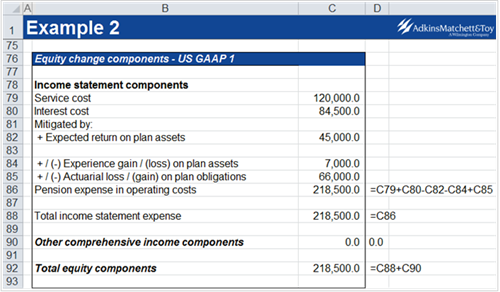

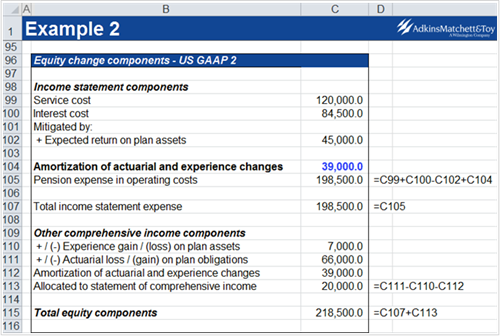

The equity change components are now more complex and include both an experience gain on plan assets and an actuarial loss on plan obligations. The equity changes are summarized as follows:

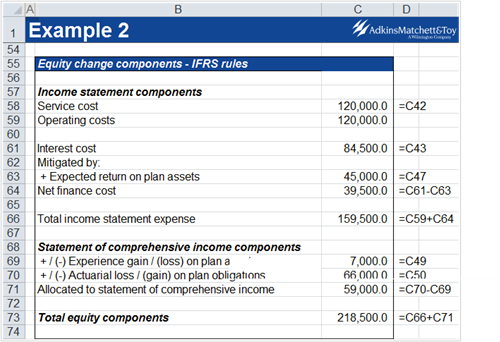

The interesting point is whether these line items should go into equity via the income statement/profit and loss account or directly to equity via the statement of comprehensive income. Under IFRS the income statement/profit and loss account and the statement of comprehensive income are impacted as follows:

IFRS does not specify which line items in the income statement / profit and loss account are impacted so care should be taken when “cleaning up” for pensions while doing an EBIT or EBITDA calculation. In this case, the service cost of 120,000 is included as an operational item whereas the remaining items are included as net interest cost of 39,500 (84,500 – 45,000). Many corporations report in this way but some will allocate the total income statement expense into operating line items. The statement of comprehensive income is impacted by the experience gain on plan assets and the actuarial loss on the obligations. These items never impact the income statement / profit and loss account under IFRS.

Under US GAAP – FULL METHOD the income statement / profit and loss account and OCI is impacted as follows:

In this case the operating costs include the entire period changes. The experience gains / (losses) and the actuarial losses / (gains) are likely to be volatile period on period and will distort reports earnings requiring “clean up” for any valuation analysis.

Under US GAAP – AMORTIZATION METHOD, the actuarial gains / losses net of any experience adjustments to plan assets are allocated directly into other comprehensive income and then amortized into the income statement / profit and loss account over time. In this case, assume 39,000 is amortized in the current period. The income statement / profit and loss account and the statement of comprehensive income are impacted as follows:

In summary

The income statement / profit and loss account is made up as follows:

|

Service cost / new pensions accrued |

Always in operating costs |

|

+ Interest cost |

Under US GAAP always in operating costs but under IFRS may be in operating or financial costs |

|

– Expected return on assets |

Under US GAAP always in operating costs but under IFRS may be in operating or financial costs |

|

+ Actuarial loss net of experience gain on plan assets |

Under IFRS not expensed. Under US GAAP either expensed in full or amortized over time |

|

Net pension expense |

|

Comprehensive income is impacted as follows:

|

+ Actuarial loss net of experience gain on plan assets |

Under IFRS included in full in the year it arises. Under US GAAP excluded in full from OCI or included and then amortized over time |

|

Comprehensive income impact |

|

Please do not hesitate to contact us, if you are having trouble viewing or accessing this article.

Copyright© 2016 AMT Training