Defined benefit pension plans are those where the sponsoring corporation bears the investment risk and as a consequence they can impact its valuation. To review the accounting rules for such plans please read our previous technical update on pension accounting.

In this article the pension adjustments for Verizon Wireless (US GAAP) and Kongsberg Gruppen (IFRS) are calculated. Download the accompanying Excel files which can be used to calculate the numbers in the examples used.

Verizon Wireless

Excel Template (https://www.amttr i Ei xc.el So/lutio n (htttpst/://wl ww.a/mttrai/n0i7Sn/gtVa.ecteroimzmoe/nwn_tpWEcxiortenraltecsntstP/upDpeFlnos(ahiodttnsp/s2v:0a//1lwu5aw/t0iwo7.n/aVmiesrtsti

Kongsberg Gruppen

Excel Template (https://www.amttr i Ei xc.el So/lutio n (htttpst/://wl ww.a/mttrai/n0i7Sn/gtKa.octeonmgse/bwnetprEgcx_otGnratrecuntpt(p/PueDpnlFop)ae(dnhst/ti2po0sn1:/v5/wa/0wlu7wa/Kt.iaomn

Enterprise value impact

If the pension fund has a significant deficit then the valuation specialist must consider treating it as a debt equivalent. The logic is that, in such a situation, the pension fund is effectively providing funding to the business and is in fact part of the capital structure. The starting point is to find the latest available valuation of the obligations net of the value of any ring fenced assets (funded plans). The footnotes always provide this information although in an M&A situation the buyer may wish to hire an actuary to do a separate valuation as part of the due diligence process.

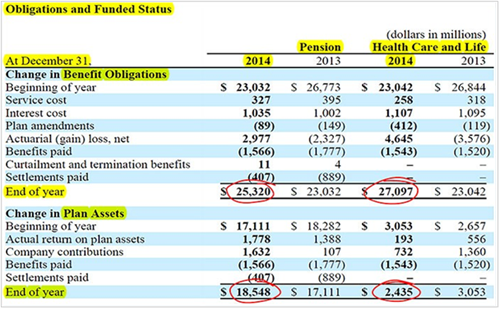

For Verizon Wireless, this is what is disclosed:

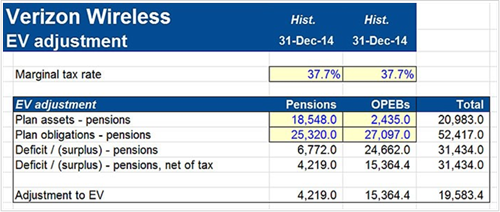

Both the pension and the health care plans are funded since they both have assets set aside to meet the obligations. In the US, any payments into a plan are tax deductible therefore the cost to the business of paying for these obligations is less because of the tax shield. This means that the effective funding the business receives is the deficit * (1 – marginal tax rate). For Verizon Wireless the debt equivalent is as follows:

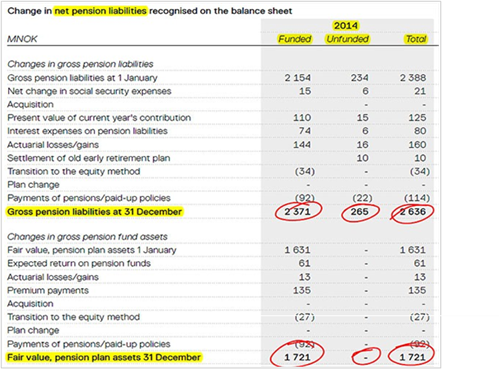

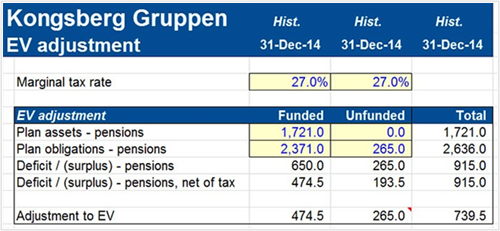

The process is the same for a business reporting under IFRS but in parts of Europe unfunded plans are more common. In these cases the tax deduction often applies when the cost is expensed rather than when the payment is made and if this is so there is no argument for tax affecting the deficit since the benefit has already been received by the business concerned. The footnotes for Kongsberg Gruppen show that they have both funded and unfunded plans as follows:

The associated enterprise value debt equivalents are calculated in the same way but the unfunded plan deficit is not tax affected for valuation purposes.

EBIT Calculations

If the post retirement plans are being treated as a debt equivalent, by including the obligation and asset in the valuation as financial items, then the interest expense and asset returns should also be treated as financing in nature. Depending on how the pension expense has been allocated into the income statement an adjustment may or may not be required to EBIT. The footnotes will indicate where the expense has been allocated and if they do not then it is assumed it has been treated as an operating cost in its entirety (common under US GAAP and possible but less common under IFRS).

|

Summary of accounting and valuation treatments for postretirement plan expense components |

||

|

Expense component |

Accounting treatment |

Valuation treatment |

|

Service cost / new pensions accrued |

In operating costs |

Operating |

|

+ Interest cost |

Under US GAAP always in operating costs but under IFRS may be in operating or financial costs |

Financing |

|

– Expected return on assets |

Under US GAAP always in operating costs but under IFRS may be in operating or financial costs |

Financing |

|

+ Actuarial loss net of experience gain on plan assets |

Under IFRS, not expensed. Under US GAAP either expensed in full or amortized over time |

Nonrecurring |

|

Net pension expense |

|

|

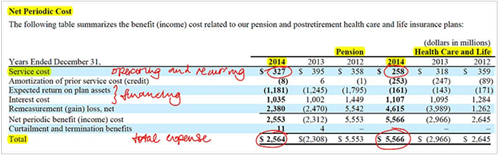

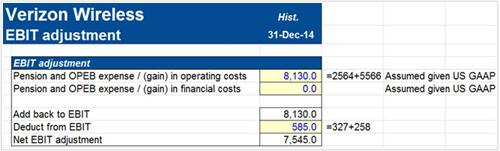

The footnote for Verizon Wireless gives the breakdown of the expense into its component parts but is silent on where they are allocated in the income statement therefore it is assumed it is in operating costs. This means that both financial and nonrecurring items are embedded in EBIT. The simplest way to adjust is to remove the entire expense and replace it with the operating element, the service cost.

The adjustment to EBIT is as follows:

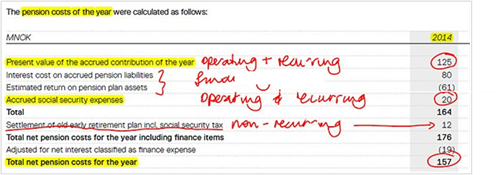

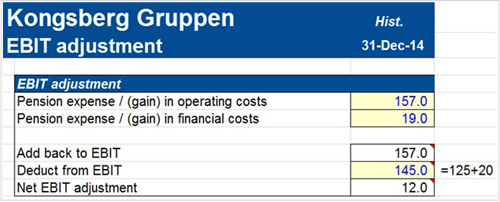

For Kongsberg Gruppen however, the financial items have been allocated “below the line” and hence no adjustment is necessary. The operating items are the accrued contribution and social security costs for the year. In this case there is a nonrecurring item which should be adjusted for if this has not already been done when calculating the base line EBIT. The foot note and adjustment is shown below.

In summary, a valuation specialist who is comfortable with what to look for and where to look will always find an adjustment for post retirement plans to be relatively straightforward.

Please do not hesitate to contact us, if you are having trouble viewing or accessing this article.

Copyright© 2016 AMT Training