This is a story about two companies, Company X and Company Y. The CEOs of the two companies Mr. X and Mrs. Y are considering various strategies to achieve the highest valuation multiple. They didn’t quite know whether to pursue strategies that would lead to higher growth or to pursue strategies that would lead to higher profitability. In this technical update we will attempt to address their dilemma.

In our valuation multiples how high is too high technical update, we had spoken about the P/E multiple. Here, we will discuss enterprise value multiples. We will begin by establishing what drives value for a company. We will then see how these drivers are linked to multiples. Linking value drivers to multiples can give insight about how to evaluate various corporate strategies and their impact on multiples.

What drives value?

Value creation is driven by three factors:

- Return on Invested Capital (ROIC)

- Cost of capital (WACC)

- Organic growth (g)

The formula that links, value to these three factors is called the Value Driver Formula and is as follows:

- Value = EBIT*(1tax)*(1g/ROIC)/ (WACC – g)

This formula is also called the ZEN of corporate finance, since it links the value of the company to the fundamental drivers of value viz., ROIC, WACC and growth. Now let’s see the impact of these drivers on multiples.

Key Value Driver Formula

Dividing both sides by EBIT, we are left with a very popular multiple that bankers use to value companies.

- Value/EBIT = (1t)*(1g/ROIC)/(WACCg)

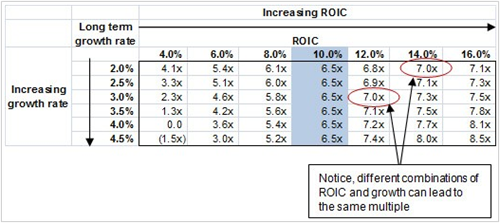

This multiple is known as an enterprise value multiple. It tells us the value attributed by the market per dollar of EBIT. In the table below, we have calculated this multiple for various combinations of growth and ROIC. WACC is assumed to be 10.0%.

From this table we can make three observations:

As long as the spread between ROIC and WACC is positive, new growth creates value and a higher multiple. In fact, the faster the firm grows, the more value it creates.

If the spread is equal to zero, the firm creates no value through growth. The firm is growing by taking on projects which have a net present value of zero. Therefore, if the spread between ROIC and WACC is zero faster growth does not translate into a higher multiple.

When the spread is negative, the firm destroys value by taking on new projects. If a company can not earn the necessary return on a new project or acquisition, its market value will drop. In other words, if the spread is negative a higher growth will lead to lower multiples

Mr. X and Mrs. Y now know that pursuing growth makes sense only when ROIC is greater than WACC. They also know that to achieve a particular multiple they can adopt different combinations of ROIC and growth. This can help them evaluate and choose from the various strategic options available to them.

Other practical applications of the value driver formula

Reverse engineering the multiple

Any observed EV/EBIT multiple can be reverse engineered to analyze the implied assumptions about its drivers. For example, we are analyzing a mature business with a growth of 3.0%, ROIC of 15%, WACC of 10% and a tax rate of 30.0%. Applying the value driver formula we know that the correct multiple for the stock should be 8.0x. Let’s say the stock is trading at 6.0x, should we buy or sell?

Establishing multiples for a private company

The value driver formula can help establish multiples for a private company given growth, ROIC and WACC

Terminal value calculation in DCF

The value driver formula can be used to calculate terminal value in DCF calculations. This methodology makes sure that the long term growth rate is in consistent with ROIC, and reinvestment rate assumptions.

Please do not hesitate to contact us, if you are having trouble viewing or accessing this article.

Copyright© 2016 AMT Training